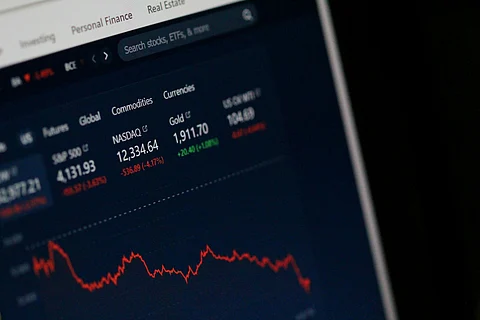

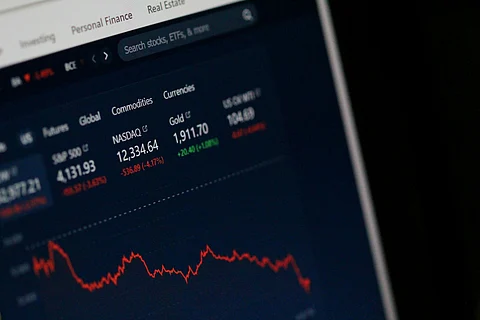

U.S. markets pulled back Tuesday with the Nasdaq falling nearly 2% as investors grapple with multiple warning signs in the economy. The downturn follows recent market volatility triggered by trade tensions and concerns about consumer financial health.

The tech-heavy Nasdaq Composite dropped approximately 1.7%, dragged down by Nvidia and other tech leaders. The S&P 500 declined 1.1% while the Dow Jones Industrial Average fell 0.6%. This retreat comes after the market briefly entered correction territory last week amid escalating trade disputes.

A particularly troubling indicator has emerged in consumer finances, with auto loan defaults reaching levels not seen since before the 2008 financial crisis. Nearly 6.6% of subprime auto borrowers were at least 60 days delinquent in January 2025, according to Fitch Ratings.

President Trump's recent announcement of doubled tariffs on Canadian steel and aluminum sent markets tumbling last week, though they partially recovered after Ontario's premier agreed to remove electricity surcharges that had prompted the trade action. The president suggested that making Canada "our cherished Fifty First State" would eliminate tariff issues.

Financial strains on consumers continue mounting with new vehicles averaging $47,000 and used vehicles around $25,000. Interest rates have climbed to over 9% for new cars and approximately 14% for used ones, while insurance premiums have increased 19% year-over-year.

Investors now turn their attention to the Federal Reserve's two-day policy meeting for insights on economic health and potential responses to inflation and trade disruptions.