Amid ongoing U.S. trade negotiations with China, a new sanctions bill introduced by Senator Lindsey Graham (R-SC) could undermine and potentially derail the fragile talks. The proposed legislation, described by Graham as “bone-crushing sanctions” against Russia, would place 500% tariffs on countries purchasing Russian oil, gas, uranium, and other products.

While the bill is framed as targeting Russia, its true impact would be felt by nations that continue to do business with Moscow—most notably China and India, which collectively purchase around 70% of Russian oil. Graham emphasized this figure during his visit to Kiev on Friday, where he announced that the U.S. Senate would begin advancing the bill on Monday.

If enacted, the 500% tariffs would be nearly 17 times higher than the current 30% tariff rate on Chinese imports and more than triple the peak of 145% that was briefly imposed in April. That previous hike had to be walked back after just weeks, as the Trump administration negotiated a 90-day pause on further tariffs with Beijing on May 14 and agreed to scale the duties back to 30%.

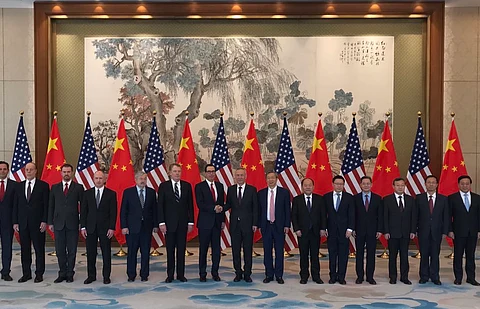

On Thursday, U.S. Treasury Secretary Scott Bessent told Fox News that trade talks with China had stalled. Then on Friday, President Donald Trump had an outburst against China in a Truth Social post, accusing Beijing of violating the May agreement and claiming he only agreed to the temporary tariff pause to prevent the collapse of China's economy.

Trump’s comments reflect his growing frustration with the lack of progress ahead of the August deadline when the 90-day pause is set to expire. Asked about Graham’s bill on Friday, Trump neither endorsed nor opposed it, stating only, “I have to see it. I’ll take a look at it.”

China has not yet publicly responded to the proposed legislation. However, should the bill pass—with strong bipartisan support suggesting a potential two-thirds majority in Congress—it could be veto-proof, meaning even a presidential veto could be overridden. If codified into law, the 500% tariffs would become permanent and could not be reversed through executive action, severely undermining the potential for any meaningful trade agreement with China.

Analysts warn that enshrining such extreme measures into law may render future U.S.–China trade negotiations effectively moot, especially as tensions escalate and both sides harden their positions ahead of a potential showdown in August.